The Impact of Credit Cards on Personal Finance: Strategies for Conscious Use

The Role of Credit Cards in Personal Finance

In today’s fast-paced world, credit cards serve as more than just a payment tool; they embody a way of managing finances that can either enhance or complicate life. As we navigate through various purchasing scenarios—from the convenience of online shopping to the unexpected medical emergencies—credit cards have become ingrained in the American financial system.

Convenience and Ease of Transactions

The convenience that credit cards offer is undeniable. With a simple swipe or click, consumers can complete transactions seamlessly, whether in physical retail stores or e-commerce platforms. For instance, during holiday seasons or major sales events like Black Friday, credit cards allow shoppers to capitalize on special offers without needing to carry large amounts of cash. This convenience extends to subscription services, where consumers can enjoy uninterrupted access to their favorite content—be it streaming music, movies, or even meal delivery—without the hassle of payment reminders. However, this ease of access can also encourage impulse buying, leading to unnecessary expenditures.

Rewards Programs

Another attractive feature of credit cards is their rewards programs. Many cards offer enticing benefits such as cash back on purchases, travel points, or discounts on specific services. For example, a card that offers 2% cash back on groceries can be a smart choice for families, providing tangible savings on everyday spending. Additionally, travel rewards can be particularly appealing to frequent travelers, allowing them to earn points that can be redeemed for flights or hotel stays. However, it’s crucial to read the fine print; some rewards come with restrictions that might not serve the cardholder’s base spending habits, potentially negating expected benefits.

Access to Emergency Funds

Credit cards also function as a form of emergency fund. In situations where unexpected expenses arise, like a car repair or medical bill, having a credit card can provide quick access to funds that may not be readily available in a checking or savings account. This access can prevent financial stress and the need to resort to high-interest loans. However, the emotional safety net of a credit card should not lead to complacency; consumers must remain vigilant and limit reliance on credit for routine expenses to prevent a cycle of debt.

Understanding the Risks

Despite these benefits, the risks associated with credit cards cannot be overstated. Mismanagement can lead to debt accumulation that can spiral out of control, especially when minimum payments are viewed as a green light to overspend. The high-interest rates on unpaid balances can quickly erode any rewards or benefits gained. Moreover, consistent late payments can severely affect an individual’s credit score, impacting their ability to secure favorable loans in the future. Thus, it is paramount to develop smart spending habits, such as paying off balances each month and budgeting expenses accordingly.

Effective Strategies for Managing Credit Cards

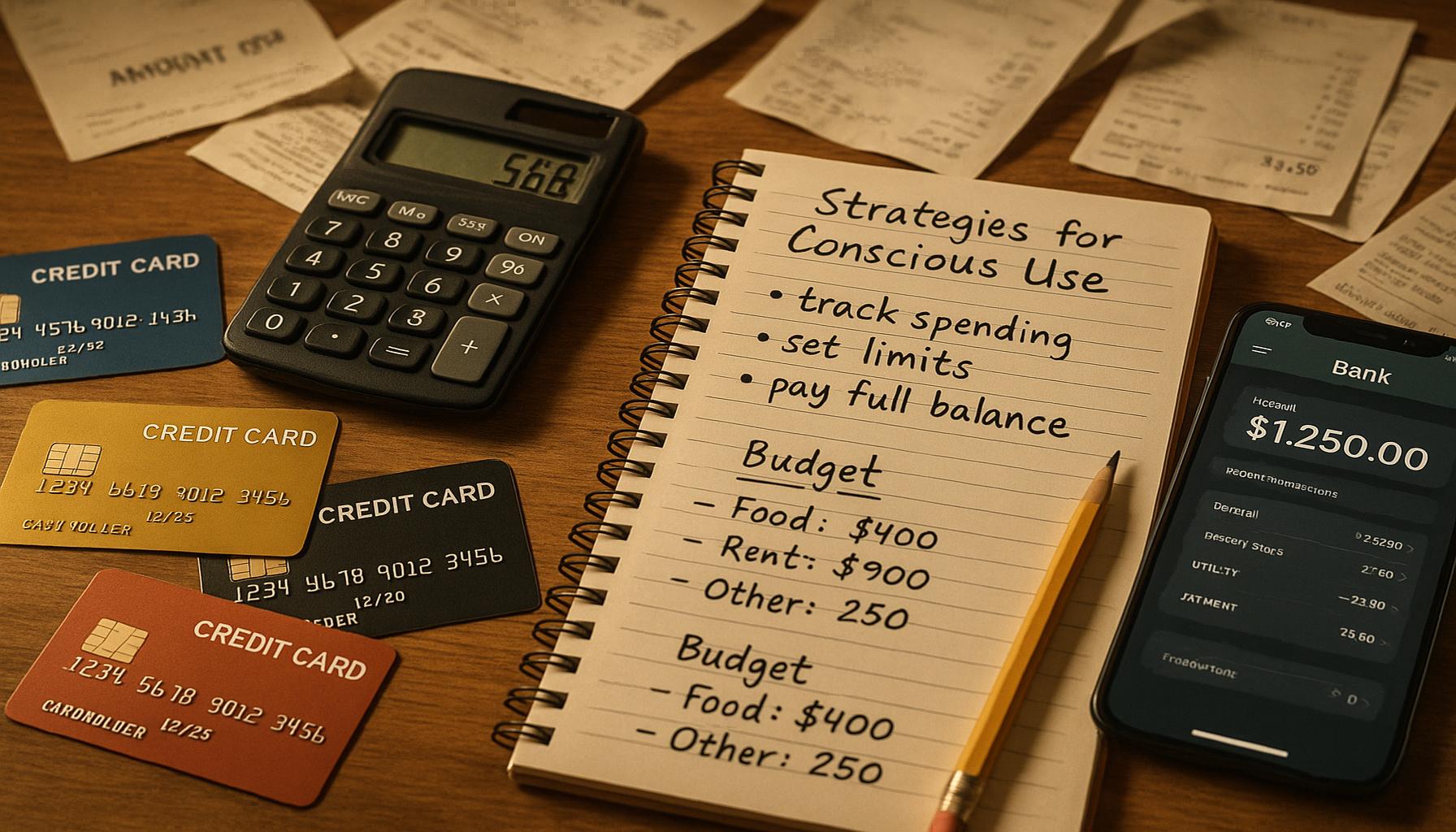

To navigate these complexities, adopting conscious strategies is essential. Consumers should track their spending and regularly assess their credit card statements to ensure they are not exceeding their budgets. Setting reminders for payment due dates can help maintain a good payment history and avoid late fees. Furthermore, understanding the terms and conditions of credit cards—including interest rates, fees, and rewards—can help users make informed decisions tailored to their financial needs.

As credit cards continue to play a significant role in personal finance, being informed about their advantages and risks is vital. By harnessing the power of credit cards with responsibility and strategic planning, individuals can reap the benefits while effectively safeguarding their financial future.

LEARN MORE: Click here to boost your credit score

Navigating the Benefits and Pitfalls of Credit Cards

Credit cards are often touted as the backbone of modern financial management, offering both opportunities and challenges that require careful consideration. As individuals embrace the convenience these cards provide, it is essential to recognize how to utilize them effectively while mitigating risks that come with their misuse. Understanding the inherent features of credit cards allows users to make choices that align with their personal financial goals and lifestyle.

The Allure of Instant Gratification

In an era where instant gratification reigns supreme, credit cards cater to our desire for immediate access to goods and services. Consumers can shop online or in-store without the need to save up for purchases, making it all too easy to fall into the trap of overspending. The thrill of buying something new can overshadow the reality of accruing debt. Research shows that the likelihood of spending more increases when using credit cards compared to cash, as the transactional nature of swiping a card feels less tangible than handing over physical currency. It is crucial for cardholders to maintain awareness of their spending habits to avoid this common pitfall.

Setting Financial Boundaries

One practical approach to overcoming impulsive spending is the establishment of financial boundaries. Here are several strategies to help manage credit card use:

- Create a budget: Outline monthly income and expenses to develop a realistic spending plan that accommodates credit card usage.

- Set spending limits: Decide on a specific amount for discretionary purchases on credit, ensuring total expenses remain within the financial plan.

- Use only one card: Limiting the number of credit cards in use can simplify tracking expenses and managing payments, reducing the temptation to overspend.

- Automate payments: Setting up automatic payments for the total balance or a predetermined amount can help avoid late fees and enhance creditworthiness.

The Importance of Timely Payments

One of the most crucial aspects of credit card management is the timely payment of bills. Credit card companies typically charge high interest rates on balances carried from month to month. Late payments not only result in additional fees but can also lead to a decline in credit scores, which might hinder future loan applications or result in less favorable interest rates. Establishing a regular payment schedule and understanding billing cycles can significantly reduce these risks while promoting a positive credit history.

Harmonizing Credit with Financial Goals

Ultimately, the impact of credit cards on personal finance transcends mere transactional convenience. By approaching credit card use with a strategic mindset, individuals can align their spending with long-term financial goals. Whether it is saving for a home, planning for retirement, or simply managing day-to-day expenses, integrating credit cards into a broader financial framework can enhance overall financial well-being. With responsible use and vigilant management, credit cards can serve as valuable tools rather than instruments of debt.

LEARN MORE: Click here for details on applying

Maximizing Rewards While Minimizing Debt

For many individuals, credit cards present an enticing opportunity to earn rewards, cash back, or travel points. However, this aspect can also mislead users into overspending, thinking they are gaining benefits while accumulating debt. Understanding how to leverage reward systems effectively can significantly influence credit card use and overall financial health.

Understanding Reward Programs

Credit card companies often offer various reward programs, ranging from cash back on everyday purchases to points redeemable for flights and hotels. When used strategically, these rewards can enhance your financial experience. However, to avoid falling prey to temptation, it is essential to assess the benefits against potential costs. For example, if the perks of a cash-back card encourage spending beyond one’s budget, the potential rewards might evaporate under the weight of high-interest debt.

Before selecting a card based on rewards, ask yourself essential questions: What kind of purchases do I make most frequently? and Am I willing to pay higher annual fees for specific rewards? Aligning credit card benefits with regular spending habits ensures that users not only earn rewards effectively but do so without leading themselves into a cycle of debt.

The Power of Financial Literacy

Another pivotal factor in responsible credit card use is financial literacy. Knowledge about interest rates, credit utilization, and the terms of credit agreements empowers individuals to make informed decisions. For example, understanding how interest is calculated can prevent users from carrying a balance that leads to excessive charges over time. A staggering 39% of Americans admit they don’t fully understand how credit card interest works, highlighting the importance of education in promoting responsible usage.

Engaging in financial literacy programs or exploring online resources can offer invaluable insights into budgeting, debt management, and the nuances of credit scores. When people are empowered with knowledge, they can navigate the world of credit more effectively, achieving financial stability while taking advantage of the benefits credit cards offer.

Utilizing Tools and Technology

The digital age has brought numerous tools that assist in monitoring and managing credit card use. Budgeting apps and financial management platforms can track spending in real time, alerting users when they approach their budgets or when unusual spending patterns arise. Integrating technology into budgeting practices not only streamlines the management process but also fosters greater awareness of financial behavior.

Additionally, many credit card issuers now provide platforms that allow users to set alerts for due dates, spending limits, and potential fraud. By leveraging these resources, individuals can stay proactive rather than reactive in their financial practices, minimizing the risk of debt accumulation while maximizing the benefits associated with credit card use.

Understanding Your Credit Score

An often-overlooked aspect of credit card use is its impact on credit scores. Credit utilization—the ratio of credit card balances to credit limits—plays a significant role in determining one’s creditworthiness. Keeping utilization below 30% of total available credit is ideal for maintaining a healthy credit score. This simple guideline can greatly influence future loan opportunities, from mortgages to car loans, resulting in lower interest rates and better financial offers.

Monitoring credit scores regularly, perhaps through free resources provided by credit bureaus, allows individuals to catch any discrepancies and correct them promptly. Over time, cultivating a strong credit score through mindful credit card use can pave the way for financial advantages that extend beyond just the immediate perks of rewards programs.

DISCOVER MORE: Click here to uncover essential financial habits

Conclusion

The journey into the world of credit cards holds the potential for both financial empowerment and peril. By embracing the strategies outlined throughout this article, individuals can harness the benefits of credit cards while mitigating their risks. A strong foundation in financial literacy enables consumers to navigate the complexity of interest rates and credit utilization, empowering them to make informed choices. Understanding your spending habits and aligning them with appropriate reward programs not only enhances the credit experience but also encourages deliberate and conscious spending.

The integration of modern technology, such as budgeting apps, can further enhance financial decision-making and promote healthier spending behaviors. By utilizing such tools, individuals can maintain oversight of their credit use, ensuring they remain within budget while also taking advantage of potential rewards.

Perhaps most importantly, we must recognize that successful credit card management is a balancing act—one that requires continuous awareness and reflection. Individuals should keep a vigilant eye on their credit scores and utilize this metric to gauge their financial health. By maintaining a healthy credit utilization ratio and avoiding the pitfalls of debt accumulation, consumers can create a robust financial future that supports their long-term goals.

Ultimately, the impact of credit cards on personal finance lies largely in the hands of the user. By fostering a culture of conscious use and adopting strategic practices, individuals can confidently navigate the credit landscape, ensuring that credit cards serve as tools for financial growth rather than obstacles on their path to financial success.

Related posts:

How to Apply for Bank of America Premium Rewards Credit Card Today

Investments and Credit Cards: How to Maximize Returns Using Smart Credit

How to Apply for the American Express Gold Credit Card Online

How to Apply for the HSBC World Elite Mastercard Credit Card

Apply for Choice Privileges Select Mastercard Credit Card Step-by-Step Guide

How to Apply for the USAA Advantage Credit Card Easy Steps

Linda Carter is a writer and financial expert specializing in personal finance and financial planning. With extensive experience helping individuals achieve financial stability and make informed decisions, Linda shares her knowledge on the our platform. Her goal is to empower readers with practical advice and strategies for financial success.